In a recent New York Times piece, “How Can Biden Bring Back Manufacturing Jobs? Weaken the Dollar,” Noam Scheiber leads with the following paragraph: “President Biden has made reviving American manufacturing a top priority. To deliver, he may first have to deal with something even more fundamental to the U.S. economy: the strength of the dollar.”

Then, Scheiber goes on to argue that the “dollar strength over much of the last few decades has bloated the U.S. trade deficit.” This is not so.

The negative external balance in the U.S. is neither a “problem,” nor has it been caused by the dollar’s “strength” and “overvaluation.” The U.S.’ negative external balance, which the country has registered every year since 1975, is “made in the USA.” It is a result of our savings deficiency.

To view the external balance correctly, one must look to the domestic economy. The external balance is homegrown: It is produced by the relationship between domestic savings and domestic investment. Foreigners only come into the picture “through the backdoor.” Countries running external-balance deficits must finance them by borrowing from countries running external-balance surpluses.

It is the gap between a country’s savings (read: income, minus consumption) and domestic investment that drives and determines its external balance. This fact can easily be seen by studying the savings‐investment identity: CA = Sprivate – Iprivate + Spublic – Ipublic. CA is the current-account balance, Sprivate is private savings, Iprivate is private domestic-investment spending, Spublic is government savings, and Ipublic is government domestic-investment spending. In this form, Sprivate – Iprivate is the savings‐investment gap for the private sector and Sprivate– Ipublic is the savings‐investment gap for the government sector.

First, the national savings‐investment gap determines the current-account balance. Both the public and private sector contribute to the current-account balance through their respective savings‐investment gaps. The counterpart of the current-account balance is the sum of the private savings‐investment gap and public savings‐investment gap (read: the public-sector balance).

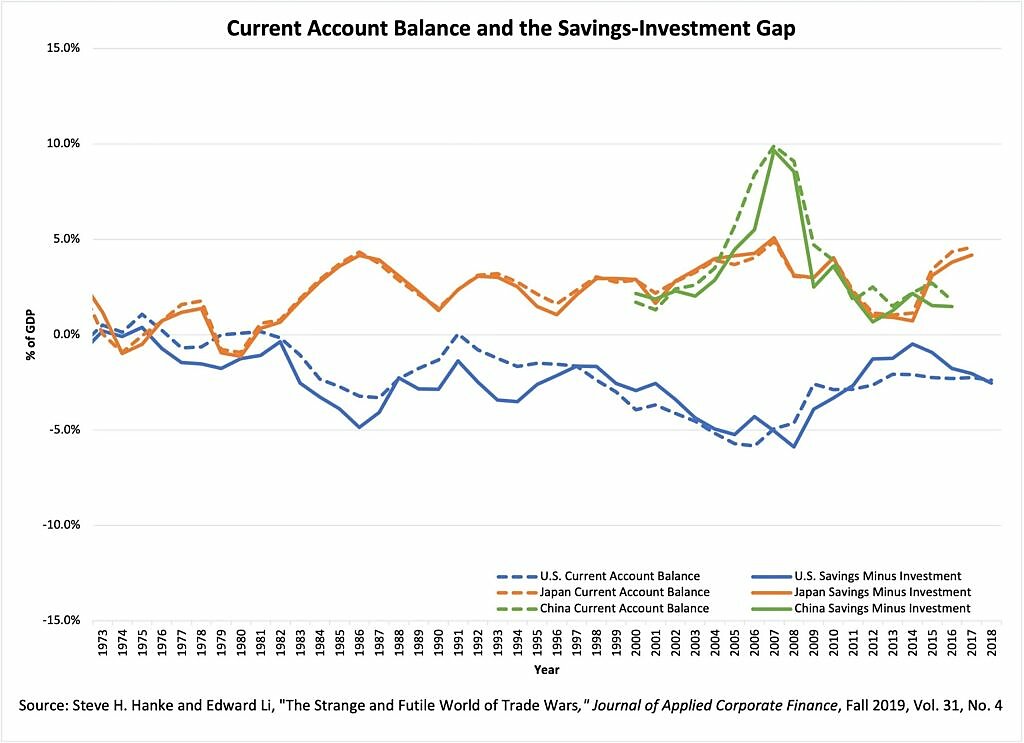

The U.S. external deficit, therefore, mirrors what is happening in the U.S. domestic economy. This holds true for any country, even those with significant external surpluses. The chart below, which comports with the savings‐investment identity, makes this clear. The U.S. displays a savings deficiency and a negative current-account balance that reflects its negative savings‐investment gap. Japan and China display savings surpluses, and both run current-account surpluses that mirror their positive savings‐investment gaps.

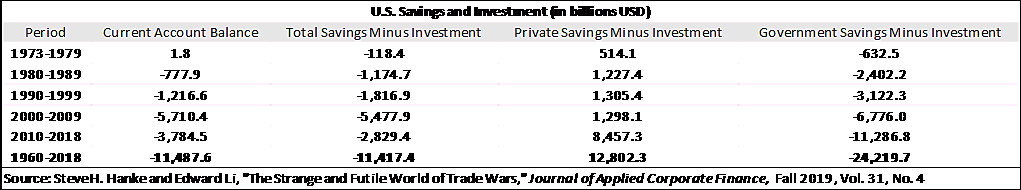

The table below shows again that U.S. data support the important savings‐investment identity. The cumulative current-account deficit the U.S. has racked up in the 1973–2018 period is $11.49 trillion, and the amount by which total savings has fallen short of investment is $11.42 trillion. But that is not the end of the story. Disaggregated U.S. data allow us to calculate both the private and government contributions to the U.S. current-account deficit. As shown in the table, the U.S. private sector generates a savings surplus — that is to say, private savings exceed private domestic investment — so it actually reduces the current-account deficit. The government stands in sharp contrast to the private sector, accounting for a cumulative savings deficiency — that is to say, government domestic investment exceeds government savings, resulting in fiscal deficits — that is almost twice the size of the private-sector surplus. Clearly, then, the U.S. current-account deficit is driven by the government’s (federal, plus state and local) fiscal deficits. Without the large cumulative private-sector surplus, the cumulative U.S. current-account deficit since 1973 would be almost twice as large as the one that’s been recorded.

The straightforward implication of this analysis is that President Biden should ignore pleas to tank the dollar in the interest of closing the U.S. trade and current-account deficits. The U.S. current-account deficit is solely a function of the savings deficiency in the U.S., in which the government’s fiscal deficit is the proverbial elephant in the room. And how is the current-account deficit financed?

Well, it turns out that foreigners who generate savings surpluses and current-account surpluses finance U.S. deficits. It is clear, therefore, that current-account balances represent nothing more than a measure of the international trade in savings.

What’s more, the Biden administration’s fiscal policies, which promise massive fiscal deficits as far as the eye can see, will result in huge trade and current-account deficits as far as the eye can see. The U.S. current-account deficit will therefore not only continue to be made in the good old U.S.A., but it will be greatly enlarged by the Biden administration.

The good news, however, is that the U.S. has been able to finance its deficits with relative ease. Indeed, foreigners are more than willing to park their savings in dollar-denominated assets. This is a tribute to the dollar’s role as the world’s reserve currency, America’s creditworthiness, and the effectiveness of U.S. corporate governance.

The level of intellectual confusion that surrounds the strange world of international-trade policy is stunning. We have irrefutable arguments and evidence to explain why a country’s external balance is determined domestically, not by foreigners or the value of the dollar relative to its currency. In spite of the facts, many still believe that the strength of the U.S. dollar explains America’s external deficit. As a result, and as the history of trade policy shows, it’s difficult to change false beliefs with facts. Just look at how former President Trump was bamboozled with nonsensical arguments about the sources of America’s trade and current-account deficits. Now, will it be President Biden’s turn? Hopefully, he won’t take the bait.