Congress should

• repeal all legislation and regulations that mandate public disclosures relating to the purchase and sale of securities;

• replace those laws if necessary only with legislation that has been shown to actually promote price discovery or deter fraud without undue cost;

• extend the provisions of the IPO on-ramp in Title I of the JOBS Act of 2012 to all companies making an initial public offering;

• impose the terms of Section 404 of the Sarbanes-Oxley Act only on companies that have demonstrated insufficient internal controls;

• authorize public companies to use the offering exemption under Regulation A;

• define any off-exchange offering as “nonpublic” and therefore exempt from registration, and open all such offerings to investment from any investor regardless of wealth; and

• create a de minimis exemption for any offering of less than $500,000.

The world benefits from the innovations brought to market by the companies that develop new medical treatments, safety features, communication technologies, and other products and services that make modern life as safe and comfortable as it is. These companies, both those in the United States and many based abroad, rely on the U.S. capital markets to fund their work. Capital markets exist to funnel resources to their best use. When functioning properly, the markets ensure that companies with the best ideas and best business models will attract the most resources.

Regulation, however, can snarl these processes, leading companies to waste resources complying with inefficient or even counterproductive rules — resources that would otherwise have been employed improving lives. Over the roughly 100 years since the introduction of government-directed securities regulation, the securities laws and implementing rules have needlessly encumbered and often profoundly distorted the proper functioning of the capital markets. Those who advocate for increased regulation typically invoke the need for improved "investor protection" or, since the 2008 financial crisis, "financial stability." But many of the existing rules, at best, have no bearing on investor protection and, at worst, harm investors by limiting the amount of risk (which includes the opportunity for gain) they may take on. Even rules that may promote investor protection — by, for example, reducing the risk of fraud — are rarely evaluated to determine the harm they may pose to the greater society. Such rules may be reducing the ability of companies to bring lifesaving products to market or limiting growth, leading to lower employment levels and impaired economic growth overall.

Existing regulation of registered securities should be dramatically pared back. Ideally, each exchange would set the rules for what disclosures are required for listed securities. Investors interested in the kind of protection afforded by mandated disclosures could restrict themselves to investing in the securities on the exchanges whose rules they find best suited to their needs. To the extent that such extensive change is not possible and federally mandated disclosures continue, these should be only the minimum needed to deter fraud and promote price discovery. No disclosure should be required unless it has been shown that it affirmatively promotes price discovery or deters fraud, and that the burden it places on all parties is justified by the benefit it imparts. Specific recommendations for regulations that should be repealed follow below, but these are, for the most part, just the most egregious examples. The entire disclosure structure is ripe for overhaul.

The Decline of the IPO and Effects on Wealth Inequality

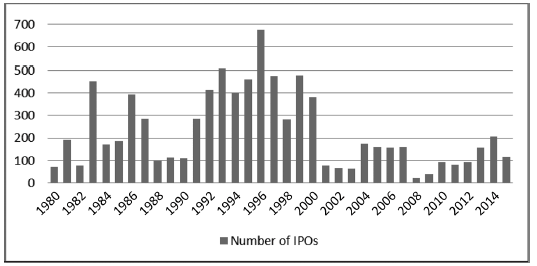

The U.S. capital markets are the envy of the world. Deep, liquid, and transparent, they have historically attracted investment from all parts of the globe. But since 2000, the number of companies opting to go public has been in decline. It is true that the nearly 700 initial public offerings (IPOs) that marked the peak of the dot-com heyday in 1996 may not be our benchmark. But even leaving out the boom years in the late 1990s, recent years have been anemic, averaging about 110 per year in the years 2001 through 2015 (see Figure 58.1). Because private investments are limited principally to institutions and wealthy individuals, the decline in IPOs contributes to wealth inequality, allowing only those who are already wealthy to share directly in companies' most explosive early growth.

Figure 58.1

Number of IPOs, 1980–2015

SOURCE: Jay Ritter, “Initial Public Offerings: Updated Statistics,” University of Florida, March 2016, Table 15.

NOTE: IPO - inital public offering.

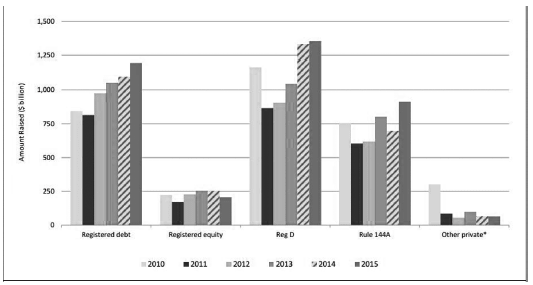

It is worth noting that the IPO decline has not been caused by negative factors alone. For example, accessing private investment has become easier since the 2012 passage of the Jumpstart Our Business Startups (JOBS) Act. As Figure 58.2 illustrates, the capital raised through private offerings dwarfs the amounts raised through public (i.e., registered) offerings. However, it is clear that the drop in IPOs cannot be solely attributed to companies freely choosing to raise only private capital. Corporate leaders express frustration at both real and perceived burdens imposed on private firms, and scholars commonly cite increased regulation as one of the main reasons for the decline in IPOs.

Congress passed the Sarbanes-Oxley Act nearly 15 years ago. It is time to revisit this legislation, evaluate its effects on the economy, and strip out those portions that have served principally as an anchor, weighing down the economy and impeding its growth. It may indeed be time to repeal the act in its entirety.

Figure 58.2

Public vs. Private Capital Raising, 2010–2015

SOURCE: Scott Bauguess, Rachita Gullapalli, Vladimir Ivanov, and Anzhela Knyazeva, “Private Securities Offerings post-JOBS Act,” Securities and Exchange Commission, PowerPoint Presentation, February 25, 2016. *Other private includes Section 4(a)(2) offerings.

The JOBS Act of 2012 provided a useful first step, exempting smaller companies from Sarbanes-Oxley's controversial Section 404 provisions for a period of time following an IPO. Section 404 requires the management of public companies to report on the adequacy of internal controls — those procedures and internal rules that ensure the company is, among other things, in compliance with regulations and that financial information is likely to be accurate — and requires the company's auditor to attest to management's assessment. This process is costly and therefore the JOBS Act, to reduce barriers for companies considering an IPO, provides certain exemptions from these requirements. There has been no indication that this exemption has led to increased corporate criminality. These exemptions should, at a minimum, be made available to all companies making an IPO. Additionally, Section 404 requirements should be imposed only after a company has shown that it has insufficient internal controls, not against all companies. Companies that can competently manage their own operations without running afoul of the law should be permitted to do so without government intervention.

Such regulatory relief would likely entice more companies to pursue IPOs and restore some of the market's lost vitality. It would also pave the way for additional review and repeal, allowing the law to be pared back to only those components that have proven effective, if any are found to exist.

Halting the Expansion of the Current Disclosure Regime

In recent years, many activists have seized on public companies' mandatory disclosures as a means of promoting causes entirely unrelated to the purposes of these disclosures. That sets a dangerous precedent. Congress should repeal rules currently in place and commit to enacting no future legislation with similar rules.

The federal securities laws are a disclosure regime. Instead of requiring that offerings be approved by the Securities and Exchange Commission (SEC) as "fair, just, and equitable to the investor" as many state-level "merit review" regimes require, the Securities Act of 1933 and the Securities Exchange Act of 1934 require only that issuers provide a certain level of disclosure to the public as part of registering an offering for public sale. The scope of these disclosures has long been understood to encompass only information for which there is "a substantial likelihood that the disclosure ... would have been viewed by the reasonable investor as having significantly altered the 'total mix' of information made available." That is to say, information should be disclosed if it would help an investor determine the appropriate price for the investment, given its potential returns.

The 2010 Dodd-Frank Act included a number of rule-making requirements motivated by activists' interests and not investor protection. The most notorious, the "conflict minerals" rule, mandates that public companies disclose whether any of certain minerals used in their products were sourced from specific geographic areas. The motivation behind the disclosure was, according to the SEC, congressional "concerns that the exploitation and trade of conflict minerals by armed groups is helping to finance conflict in the Democratic Republic of the Congo and is contributing to an emergency humanitarian crisis." The sentiment is noble, but it should not lead Congress to resort to, in the words of one former commissioner, "hijacking" existing regulatory regimes. A second, similarly misguided new rule requires public companies to disclose the ratio of the chief executive's pay to that of the company's average worker. Activists are currently working to add disclosure of political and other types of contributions to the list of disclosures.

Such disclosure requirements present two problems. The first and most pressing is that, if the SEC's disclosure regime becomes entirely untethered from its original, price-discovery function, it can be bent to any purpose at all. Furthermore, it sets a precedent for hijacking other disclosure regimes throughout the federal government. Americans should feel secure that any disclosures the government requires are carefully cabined to encompass only that information directly related to the legislation's initial intent.

Second, these disclosures often have unintended consequences. Any disclosure by a public company carries the risk of litigation if the statement is found to be either false or missing key information. Because of the difficulty in accurately tracing the manufacturing chain for minerals sourced in a low-infrastructure country like the Congo, many companies have simply stopped buying from producers in that region. That decision is harmful to the very people the rule was meant to help because it starves the region of desperately needed industry and investment. It is easy to imagine similar consequences arising from similarly misguided rules.

Congress should delineate clearly the scope of disclosures that the SEC may require, tying them tightly to the type of financial and risk-based disclosures originally contemplated by the 1933 and 1934 acts. It should also repeal those sections of Dodd-Frank that directed the SEC to promulgate the conflict minerals and pay-ratio disclosure rules, and direct the SEC to repeal the relevant implementing regulations.

Advantages of the Mini-IPO

Title IV of the JOBS Act provided much-needed relief for issuers seeking to use the Regulation A exemption for smaller-scale offerings. The exemption from registration requirements had fallen almost entirely out of use; in 2011, the year before the JOBS Act was signed into law, only one Regulation A offering was completed. But though the JOBS Act changes have shown promise, they do not go far enough. Congress should direct the SEC to extend federal preemption to all Regulation A offerings and all secondary market transactions in Regulation A–issued securities, and should eliminate the restriction that makes Regulation A available only to nonpublic companies.

In a 2012 report, the Government Accountability Office found that one of the principal reasons Regulation A had fallen out of use was the considerable burden imposed by state-level requirements. Public offerings registered with the SEC are exempt from state registration requirements, as are any private offerings conducted pursuant to Regulation D. This preemption has been instrumental to Regulation D's popularity. In issuing implementing regulations for the JOBS Act's changes to Regulation A, the SEC provided federal preemption for a subset of Regulation A offerings. But it is difficult to understand why some Regulation A offerings may proceed without state registration whereas others may not. Some states have banded together to create streamlined state registration process, dubbed "coordinated review," to reduce the burden of state-level compliance. Whether coordinated review reduces the burden is beside the point, however, if state-level registration still provides less benefit than the cost incurred to comply. The North American Securities Administration Association, the state securities regulators' industry group, has failed to explain how a two-level review process for Regulation A offerings provides any benefit to investors.

State-level regulation presents other problems as well. Although securities sold pursuant to a Regulation A offering are, from a federal perspective, freely tradable in the secondary market, state regulation puts such sales in jeopardy. Currently, restrictions remain at the state level on how a registered broker–dealer can handle these securities. Removing those restrictions on secondary trading would make the securities more liquid.

In addition, only nonpublic companies can make offerings through Regulation A. This restriction is illogical. Regulation A is a scaled-down version of a public offering, with limits on the amount a company can raise and, in some cases, on the amount investors can invest. The rationale for these limitations is that Regulation A reduces the disclosures required of the issuer. But if the issuer is a public company, it is already making the substantial and regular disclosures required of public companies. If the disclosures required under Regulation A are sufficient for an offering of that size, even without additional issuer disclosures, it is unclear why a company that makes more disclosures should be barred from using the exemption.

To the extent that issuers are turning away from the public markets, there is a need for attractive options that incorporate public investment. Regulation A mixes a light regulatory touch with investment opportunities for both retail and accredited investors, while maintaining provisions aimed at investor protection. Congress should ensure that its post–JOBS Act resurgence is fully supported by granting full federal preemption for all Regulation A offerings and opening Regulation A to public issuers.

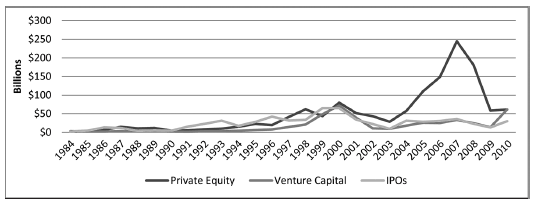

The New Private Offering

Since the 1980s, private offerings have become increasingly popular with issuers and investors alike (see Figure 58.3). Private offerings, which include those made through private equity firms and venture capital firms (the latter defined chiefly by their focus on young, high-growth companies), are characterized by their lack of required disclosures, making them both cheaper to issue and less transparent to competitors. Most are offered under Regulation D, a 1982 regulation that allows private offerings an exemption from state-level registration requirements. Although private offerings can be a boon for many companies, participation is restricted to certain investors. Currently, with very few exceptions, only individuals with more than $200,000 in annual income (or $300,000 jointly with a spouse) or assets in excess of $1 million not including primary residence, and certain institutions may invest directly in private offerings. These restrictions, especially when paired with reduced IPO volume, can exacerbate wealth inequalities. Congress should open investment in private offerings to all investors, allowing investors themselves the freedom to choose between higher-disclosure public offerings and less-regulated private offerings.

Figure 58.3

Private Equity and Venture Capital Fund Commitments and IPO Dollars Raised, 1984–2010

SOURCE: Jay Ritter, “Initial Public Offerings: Updated Statistics,” University of Florida, March 2016, Table 1A; Gregory Brown et al., “What Do Different Commercial Data Sets Tell Us about Private Equity Performance?” SSRN Working Paper, December 21, 2015, Table 5.

NOTE: IPO - inital public offering.

Most private offerings use the safe harbor provided by Regulation D — in particular, Rule 506 of Regulation D. Rule 506 allows an issuer to raise an unlimited amount of money without registering either the company or the offering with the SEC, but it places restrictions on who may buy the securities and how the securities may be presented to potential investors. Issuers typically restrict their sales to accredited investors (for the most part, institutional investors, certain high-level company insiders, and individuals who meet a specified wealth threshold) since offering the securities to nonaccredited investors triggers disclosure requirements.

Currently, the wealth and income thresholds stand at more than $1 million in assets, excluding the primary residence, or more than $200,000 in annual income for the most recent two years, or more than $300,000 jointly with one's spouse for the most recent two years, with the expectation in either case that the investor will continue to earn the same amount in the future. A recent SEC report estimates that 10 percent of American households qualify for accredited investor status.

The current focus on the wealth of the individual investor as a determiner of private offering status has created a regime in which sophisticated investors are arbitrarily barred from investing in certain offerings purely because they lack wealth, and investor protection has become a matter of protecting investors not from fraud but from bad investment decisions. It is to lawmakers' credit that federal securities laws are a disclosure regime in which any offering may be made to the public if the issuer provides the right disclosures. But an approach to investor protection that seeks to protect investors from poor choices subverts that regime, making the SEC the judge of who is and is not fit to invest. Although the federal regulator still does not conduct merit review of offerings, as many state regulators do, it in effect conducts merit review on the investors themselves, deeming only some sufficiently capable of making their own choices about how to invest and what risks to assume.

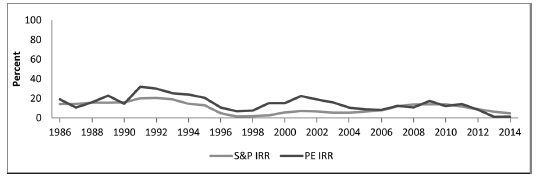

Additionally, although the restrictions on investment in private offerings are often attributed to their inherent riskiness, the numbers tell a different story. Cambridge Investments provides an index of available private investment performance data and constructs benchmarks of public indices that allow for a comparison of the internal rate of return (IRR). As Figure 58.4 shows, the IRR for private equity has largely tracked, or in many years outperformed, returns for the S&P 500.

The current rules have established private securities as an attractive investment that is, however, directly available only to an exclusive set of wealthy investors. Congress should define private offerings as any offering not listed on an exchange. And it should open all offerings to all investors. Congress could require that anyone offering securities in a private offering disclose to potential investors that the offering is private and that it therefore lacks the protections afforded by public offerings. Investors would then be able to choose for themselves whether to invest only in public offerings — if they prefer the protections in the 1933 and 1934 acts — or in more loosely regulated private offerings as well.

Figure 58.4

Private Equity vs. S&P 500 Internal Rate of Return, 1986–2014

SOURCE: Cambridge Associates, “U.S. Private Equity Index and Selected Benchmark Statistics,” PowerPoint presentation, December 2015.

If such a change in the securities laws is not politically feasible, then the category for accredited investors should at least be expanded to more accurately capture investors most likely to be able to "fend for themselves." For example, those who have passed the Financial Industry Regulatory Authority's (FINRA) basic stockbroker's exam, the Series 7, and those who have passed the exam for financial advisers, the Series 65, should be deemed financially sophisticated and be counted as accredited investors. As the law currently stands, investment advisers may advise clients to invest in securities they themselves may not buy because they are deemed insufficiently sophisticated. The category could also be expanded to allow those with expertise in a particular field to invest in offerings related to that industry. Expertise could be defined as either a university-level degree in the field or a certain number of years of experience working in the industry.

Given the size of the private equity markets and the extent to which they currently dwarf the public markets, the bar that keeps the vast majority of the population from sharing in this engine of wealth is at odds with a democratic society. More opportunities for investment would result in more opportunities to build wealth as well as more opportunities for businesses to access needed capital to grow, adding jobs and building our economy.

Bringing Friends and Family Out of the Shadows

Although past guidance recommended a consideration of all facts surrounding an offering to determine whether it constitutes a "public" offering, this understanding has largely faded. Regulation D and its predecessors, Rule 146 and Rule 242, as well as the Ralston Purina case helped cement the notion that whether an offering is public or private turns principally on whether the investors are rich or not. The absurd result is that even a tiny offering to a tiny group of investors who are close personal friends and relatives of the issuer's executives may still be deemed a "public" offering requiring registration. These tiny offerings — in which an aspiring restaurateur or a couple of friends building an app in someone's garage ask their parents, cousins, and good friends to "go in on" the enterprise with the hope of getting "a cut of the profits" down the road — still happen. And they happen without registration, often without the issuer ever understanding that the transaction being proposed is in fact a sale of securities (typically something akin to common stock) to unaccredited investors.

It is arguably within the SEC's authority to deem such offerings exempt, either as nonpublic offerings or through its authority to exempt "any class of securities ... if it finds that the enforcement of [the registration requirements of the Securities Act] with respect to such securities is not necessary in the public interest and for the protection of investors by reason of the small amount involved or the limited character of the public offering." The SEC has not, however, used this authority to provide such an exemption. Instead, it continues to consider these offerings to be in violation of the securities laws. Although the SEC rarely pursues enforcement actions against such offerings, it has been known to pick up the phone and issue a stern warning to violators.

It is not clear, however, why the SEC should be involved with extremely small offerings, especially if those offerings are made exclusively to friends and family. These tend to be matters based as much in social and familial relations as financial. Because few issuers are even aware their actions are governed by securities laws (or indeed that they are even acting as "issuers"), the current proscriptions do little to prevent such extra-legal offerings. Instead, they only complicate the process when an issuer grows and moves on to more formal methods of raising capital. Then the issuer must engage a lawyer to unwind its investors' positions, providing rescission offers to all early investors.

A better solution would be for Congress to enact an explicit de minimis exemption. The exemption could include a cap, for example $500,000, on the amount raised. If it was deemed necessary, there could also be a requirement that investors have a preexisting relationship with at least one senior executive within the company. This type of exemption would free the offerings that already happen, and will continue to happen, of legal encumbrance, allowing entrepreneurs to focus on building the business and ensuring their friends' and family's investments are sound ones.

Conclusion

Capital markets direct the flow of resources to enterprises. Ideally, these resources flow freely, attracted to the companies that will put them to best use based on the needs and wants of the end consumers. Regulation functions like rocks in a stream, redirecting the flow. Too much regulation, and regulation implemented without regard to its effects, risks choking the flow of capital entirely, or artificially flooding one area of the economy while leaving another dry. The trend toward ever more regulation in the financial sector has left in place regulation that provides little good while imposing great cost. Continued economic growth and progress toward healthier, more comfortable lives depend on ripping out those regulations that neither deter fraud nor improve price and only serve to stymie growth and innovation.

Suggested Readings

Doidge, Craig, Andrew Karolyi, and René Stulz. "The U.S. Left Behind? Financial Globalization and the Rise of IPOs Outside the U.S." Journal of Financial Economics 110 (2013): 546-73.

Howaniec, Brian. "The IPO Crisis: Title I of the JOBS Act and Why It Does Not Go Far Enough." Pepperdine Law Review 42, no. 4 (2015): 845-82.

Knight, Thaya. "The Crowdfunding Catch: Government Regulations." Newsweek, May 16, 2016.

---. "A Green Light for Investment Crowdfunding." Alt-M, October 29, 2015.

---. "A Walk through the JOBS Act of 2012: Deregulation in the Wake of Financial Crisis." Cato Institute Policy Analysis no. 790, May 3, 2016.

Rodrigues, Usha. "Securities Law's Dirty Little Secret." Fordham Law Review 81 (2013): 3389-437.

Williamson, James J. "The JOBS Act and Middle Income Investors, Why It Doesn't Go Far Enough." Yale Law Journal 122, no. 7 (2013): 2069-80.

Wolfe, Lauren. "How Dodd-Frank Is Failing Congo." Foreign Policy, February 2, 2015.