The Republican Study Committee released its fiscal 2013 budget proposal this week and it’s not horrible. That’s probably a compliment given that the bar is so low on Capitol Hill that one would trip on it. According to the RSC’s numbers, federal spending as a percentage of GDP would recede to a bit over 18 percent in 2022. That’s a level of spending that hasn’t been achieved since George Bush and his fellow Republicans in Congress initiated the federal spending spree of the past ten years.

I give the RSC credit for wanting to rein in the size of the federal government. However, when it comes to budget proposals, I’m more interested in the potential impact on the federal government’s scope. Specifically, would it make it harder for the federal government to spend money on all the activities that it currently does? Unfortunately, that’s where the RSC’s budget proposal falls short.

- Not surprisingly, the proposal calls for the repeal of Obamacare. That’s good because the president’s health care law represents a massive expansion in the federal government’s scope. Hopefully, the Supreme Court is about to render that concern moot.

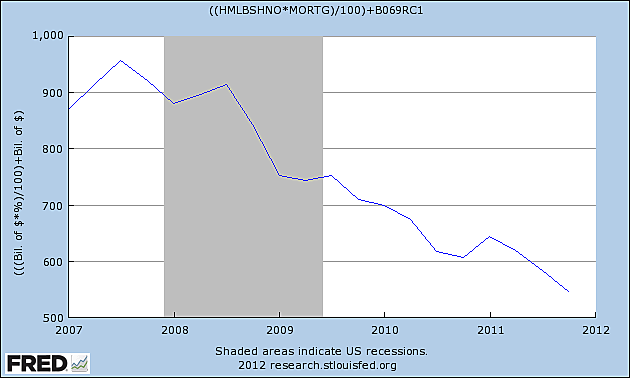

- The RSC also calls for Fannie Mae and Freddie Mac to be privatized. That would be a positive step toward reducing the federal government’s involvement in housing finance. But what about the Federal Housing Administration, which has dramatically increased its presence in the housing market and will likely need a taxpayer bailout? The RSC calls for reforming the FHA, but it ought to be abolished along with the rest of the federal government’s housing programs.

- The proposal calls for the complete elimination of the following programs: the Corporation for Public Broadcasting, Economic Development Administration (EDA), Legal Services Corporation, National Endowment for the Arts, National Labor Relations Board, the Presidential Election Campaign Fund, Trade Adjustment Assistance programs, the Universal Service Fund and a couple of higher education subsidies. I like those cuts, but there are just so many more federal programs that should get the axe. For example, the RSC is spot on when it says that the EDA “is an improper function of the federal government, essentially redistributing wealth in the name of ‘economic development.’” But the same could be said for the federal government’s entire portfolio of economic development programs. Getting rid of only the EDA won’t stop the federal government from continuing to stick its nose in economic development. How about abolishing the Small Business Administration?

- The RSC deserves credit for addressing agriculture subsidies. Specifically, it calls for ending direct payments to farmers, which were never supposed to become a permanent handout to begin with. The payments were supposed to end once farmers were transitioned off of the federal dole per the 1996 farm bill. The direct payments should be abolished, but the only specific farm subsidy that the RSC singles out for elimination is wool and mohair subsidies, which are a drop in the bucket. The proposal does call for the elimination of the Market Access Program and the Foreign Market Development Program, which are prime examples of corporate welfare. That’s good. But, again, the RSC’s proposal wouldn’t do anything to inhibit the ability of the federal government to continue its meddling in agriculture.

- The RSC calls for increases in military spending. That’s good news for the military‐industrial complex and our wealthy allies who free‐ride off our blood and treasure, but it’s not good news for taxpayers or even national security for that matter. It also eliminates any chance of the RSC’s proposal being taken seriously by anyone other than pro‐empire Republicans.

- On the big money budget issue of entitlements, the RSC calls for reforming and “strengthening” Social Security and Medicare. The reforms include private insurance options and premium support for Medicare, and increases in the eligibility age for both programs. No mention of private accounts for Social Security, and the transformation of Medicare wouldn’t begin until 2023. So if you’re relatively young and understand that the federal government’s intergenerational redistribution programs are a bum deal, you’ll have to look elsewhere for a friend on Capitol Hill. Again, no reduction in the federal government’s scope.

- The RSC proposal would block‐grant Medicaid to the states and freeze spending. That makes budgetary sense, but it would still mean that federal taxpayers are on the hook for an activity that is properly the domain of state government. In its “Constitutional Authority Statement,” the RSC notes the 10th amendment, which says that “The powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people.” Contrary to what the RSC says, federal taxpayers footing the bill for a federal program with fewer strings attached would not represent a step “toward restoring a more proper balance between the states and the federal government as defined in the 10th Amendment of the United States Constitution.”

In sum, the RSC deserves credit for trying to cut the size of government, but even if its proposal were to be enacted, it wouldn’t do much to rein in the scope of the federal government. That means that the RSC’s proposal only amounts to a vision for smaller big government.