Congress should

64. Global Warming and Climate Change

• reject any proposed tax on emissions of carbon dioxide;

• direct the administration to follow OMB guidelines in the calculation of the “social cost of carbon” and to use scenarios for future climate change that are consistent with observed environmental and climate change;

• direct the relevant federal agencies to phase out funding for general circulation climate model studies and terminate research support for so‐called “impact studies” based upon those models; and

• determine that the Paris Agreement is a treaty and the Senate should vote for ratification or rejection under Article 2, Section 2 of the Constitution.

Several developments will create pressure for global warming legislation of some type in the coming congressional session. These include the Paris climate agreement, record high temperatures caused by the recent El Niño, the Obama administration's circumvention of the legislative process with regard to global warming policy, the Supreme Court's stay of the Environmental Protection Agency's (EPA) "Clean Power Plan," and calls for a tax on carbon dioxide emissions.

Reject a Tax on Carbon Dioxide Emissions

First and foremost, Congress should turn down any legislative proposals for a tax on carbon dioxide emissions, erroneously called a "carbon tax" by proponents. Such a tax would be as insidious as the income tax, which began as a very small levy but ultimately evolved into the fiscal and byzantine morass that it is today. A carbon tax would do the same.

It is important to understand the flaws in arguments in favor of such a tax. Proponents argue that, if the tax is implemented, the EPA will agree to no further regulation of carbon dioxide emissions. That is highly unlikely. To gain political approval for the tax, the rate will initially be set very low — so low that it will have virtually no detectable effect on emissions. At the same time, to comply with what it feels is the spirit of the 2007 Supreme Court decision on greenhouse gases in Massachusetts v. Environmental Protection Agency, the EPA will have to continue to enforce existing regulations, including the controversial Clean Power Plan. Nonetheless, proponents argue that the EPA will actually terminate all existing regulations on carbon dioxide emissions. The same logic applies: initial tax rates will be so low that existing regulations simply cannot be eliminated.

The Clean Power Plan was originally envisioned as a way to replace vast amounts of coal-generated electricity (which account for roughly one-sixth of all U.S. carbon dioxide emissions) with natural gas, which emits 60 percent less carbon dioxide than coal per unit of electrical output. The cost and maintenance of a natural gas plant is also much lower than that of a coal-fired unit. The Clean Power Plan solution seemed palatable to virtually all parties. But in its final rulemaking, the EPA abandoned that plan in favor of more and more solar and wind power, which are not acceptable because of unreliability and expense.

Carbon tax advocates argue that such a tax could be "revenue neutral" inasmuch as other federal taxes, such as the income tax, would be reduced by the equivalent amount of revenue generated by the carbon tax. That is a fantasy. Legislators will never give up an equivalent amount of revenue that they could spend on desired projects. The Heritage Foundation's David Kreutzer put it another way: we can't "expect three trillion dollars to walk down K Street unmolested" by special interests and lobbies.

Operationally, the carbon dioxide tax also fails. Proponents like to point out the experience in the province of British Columbia, where gasoline sales fell even more than predicted following the enactment of a carbon dioxide tax, even as economic growth continued. What really happened, though, is that residents, many of whom live very close to the U.S. border, simply drove over the line for fuel. And British Columbia's economic growth, which had been leading Canada, rose less than in the other populous provinces.

Supporting a carbon tax is politically and economically perilous. Congress should reject any proposals to enact one.

Direct the Administration to Recalculate the "Social Cost of Carbon"

Proponents of a carbon dioxide tax say that the cost of carbon dioxide emissions to society is so great that a tax is needed to redress a heretofore large and uncompensated environmental externality. They cite something called the "social cost of carbon" (SCC). But the way that the Obama administration calculated this figure contravenes a large number of physical, biological, and regulatory realities. As a result, Congress should direct the new administration to follow the explicit Office of Management and Budget (OMB) guidelines in calculating the SCC, including guidance on how to select discount rates, as well as requirements for reporting domestic (vs. global) costs. Additionally, the federal SCC determinations must fully incorporate the latest scientific estimates of the sensitivity of the earth's temperature to carbon dioxide increases and adequately incorporate the overwhelming scientific evidence of the positive effects of carbon dioxide on global food production and vegetation growth.

The Obama administration's SCC was generated by a federal Inter-agency Working Group (IWG) that ignored specific OMB directives with regard to the determination of the SCC and its use in cost-benefit analysis of federal actions. OMB Circular A-4 (2003) presents clear guidelines "designed to assist analysts in the regulatory agencies by defining good regulatory analysis ... and standardizing the way benefits and costs of Federal regulatory actions are measured and reported." Among the guidelines for "good" analysis are directions for selecting an appropriate discount rate for calculating future costs and/or benefits. The circular explicitly states, "For regulatory analysis, you should provide estimates of net benefits using both 3 percent and 7 percent" — with a discount rate of 7 percent representing "an estimate of the average before-tax rate of return to private capital in the U.S. economy" and 3 percent reflecting the low case. Instead, the IWG applied discount rates of 2.5, 3, and 5 percent in determining the present value of its estimate of the projected future costs resulting from carbon dioxide emissions — leaving out entirely an analysis using a 7 percent discount rate. Had the IWG included a 7 percent discount rate as guided by the OMB, they would have arrived at a substantially lower estimate of the SCC — some 80 percent (or more) below the current IWG mean SCC value.

Additionally, OMB Circular A-4 recommends, in calculating costs and benefits, "Your analysis should focus on benefits and costs that accrue to citizens and residents of the United States." Yet the administration's IWG reports (and subsequently relies upon) a value of the SCC determined from the accumulation of costs projected to occur across the globe while burying the U.S. domestic costs (which are estimated to be only 7 to 23 percent of the global value). Congress should direct the IWG to strictly follow the OMB guidelines and to highlight the costs and benefits carbon dioxide emissions have on U.S. citizens and residents.

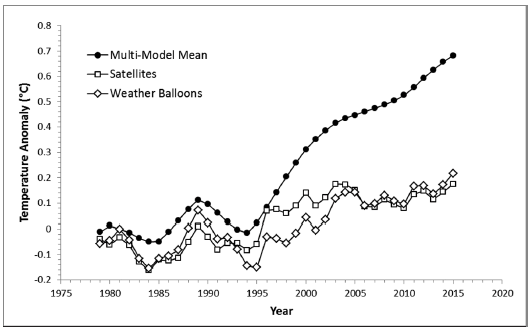

An accurate cost-benefit analysis can only be done if there is a reliable forecast for climate change and its specific impacts. The IWG, by relying on the output from published general circulation models (GCM) that simulate future climate as carbon dioxide is added to the atmosphere, is saying that those models are sufficient. They are not. Figure 64.1 shows the temporal evolution of the global average temperature of the lower-atmosphere simulated by the suite of climate models used by the United Nations' Intergovernmental Panel on Climate Change (IPCC), compared with weather balloon–sensed and satellite-measured temperatures of the same region, which is predicted to experience substantial warming from increased carbon dioxide emissions.

Figure 64.1

Lower-Atmosphere Temperatures Predicted by IPCC Models and Measured by Satellites and Weather Balloons

SOURCE: Adapted from John R. Christy, Testimony before the Committee on Science, Space, and Technology, U.S. House of Representatives, February 2, 2016.

NOTE: IPCC = Intergovernmental Panel on Climate Change.

The most logical interpretation of the ongoing (and increasing) disparity between the collectively modeled and observed temperatures (as shown in Figure 64.1) is that the forecast models are simply too sensitive to carbon dioxide changes. The IPCC's forecast global warming is 3.2°C (5.8°F) for doubling atmospheric carbon dioxide, whereas a growing body of the scientific literature, beginning in 2011, forecasts around 2.0°C (3.6°F). Several credible estimates are even lower, with a median value of 1.3°C (2.3°F). Congress should direct the IWG to recognize and incorporate these scientifically demonstrated lower forecasts of warming into its determination of the SCC — something that the IWG has thus far strongly resisted.

Additionally, Congress should direct that all SCC calculations take into account the massive increase in global food production (valued at $3.2 trillion since 1950) that is a direct result of increasing atmospheric concentrations of carbon dioxide, as well as the nearly global increase in green vegetative matter. The current models used by the IWG to determine the SCC are woefully insufficient on these accounts.

Had the IWG followed the OMB guidelines for selecting the discount rate and focused on domestic costs, and had they incorporated the latest and robust scientific findings indicating a lower climate warming and the carbon dioxide fertilization of plant life, then the social "costs" of carbon would have been greatly reduced and, in some cases, even moved into "benefits" territory.

Congress should insist on a new, more accurate, and complete analysis of the SCC from the IWG, the results of which would engender a reexamination of the cost-benefit analyses underlying a large and growing body of federal regulations.

Phase Out Funding for Large-Scale Climate Modeling

Congress should phase out funding for large-scale climate modeling and application of those models. More than four decades of spending has resulted in no improvement in the precision of future forecasts. It is noteworthy that the Australia's Commonwealth Scientific and Industrial Organization, which oversees all government-funded science there, terminated climate model funding in 2016, although it did so by declaring "success" in modeling rather than acknowledging the lack of any increase in precision.

Figure 64.1 demonstrates the failure of the current suite of climate models (general circulation models). Indeed, it has been known since the late 1980s (and acknowledged by the IPCC over 20 years ago) that GCMs predict too much warming when increases in atmospheric carbon dioxide drive climate change. At that time, the United Nations offered two alternative explanations: (1) the model forecasts were simply too warm, or (2) the forecast warming was being "hidden" by other anthropogenic emissions that counteract it.

Rather than admit the systematic failure of the GCMs, climate modelers embraced the second explanation — specifically that particulate aerosols (e.g., sulfates), which are largely a product of the combustion of coal, are counteracting warming. Recent peer-reviewed research demonstrates that this is not the case. Rather, forecasts are simply too warm.

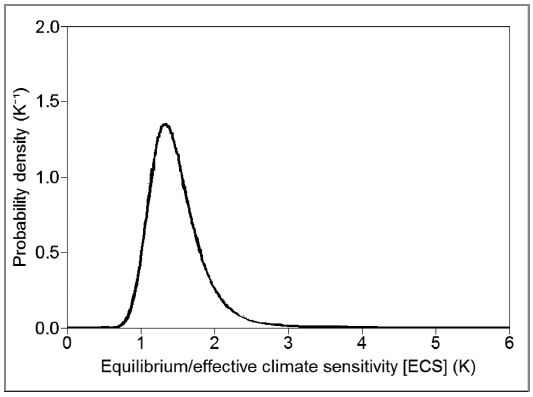

This estimate is shown in Figure 64.2 as a probability function. The most likely value (1.3°C) is the peak in the curve, and it is clear that the probabilities of much higher (and costly) warming are now vanishingly small. This dramatic improvement in narrowing the range of likely warming was not generated using the climate models, but rather is based upon observed history over the past century and a half.

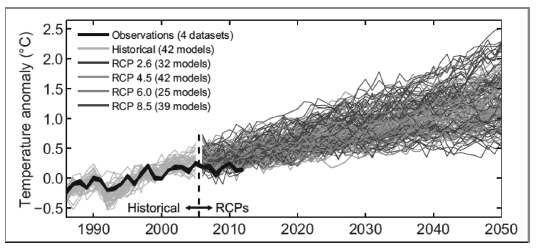

Figure 64.3 shows the global average temperature change projections from all the GCM runs in the 2013 IPCC report, out to 2050. The average warming predicted for 2001–2050 is slightly more than 1.3°C (2.3°F). But the scatter between the models is enormous by then, with the 95 percent confidence limits of the net warming ranging from 0.6°C (1.1°F) to around 2.2°C (4.0°F) above the 1986–2005 average.

Such a large spread (and large forecast rise compared with observations) is an indication that GCMs are, as a family, useless for policymaking. Congress should review the various compendia of climate change literature beginning with the 1975 National Academy of Sciences report, Understanding Climate Change. That review will reveal that the range of future warming projected in early reports is not significantly different than what is shown in Figure 64.3. After more than four decades and billions of dollars spent on a concentrated federal effort in GCM modeling, the models' forecasts have not improved and are increasingly at variance with observed warming. It is time for Congress to put an end to this charade by curtailing the pumping of taxpayer dollars into this abyss.

A remarkable finding published in 2016 by the Royal Society, the national academy of science of the United Kingdom, may explain the time and money spent. It shows that the way we reward scientists is producing, in the authors' words, increasingly "bad science." A corollary is that, if the federal government suddenly disburses enormous amounts of funding for a given field, as it has for climate studies, then the quality of research will decline significantly.

Figure 64.2

Probability Density Function of Mean Surface Warming for Doubled Atmospheric Carbon Dioxide

SOURCE: Adapted from Nicholas Lewis, "Implications of Lower Aerosol Forcing for Climate Sensitivity," Climate Etc. blog entry, March 19, 2015.

It is a common practice to use GCMs to provide a forecast, which is then used to calculate "impacts" of climate change, such as the effect on a nation's agricultural output. This type of "impacts" literature is voluminous, as evidenced by the quadrennial "National Climate Assessments" of the impact of climate change on the United States, published by the U.S. Global Change Research Program.

Clearly, using failing climate models to drive impact studies will produce an exaggerated response since the models themselves are too warm (see Figure 64.1). Further, the recent study published by the Royal Society, noted above, implies that exaggeration will be more the norm than the exception. Consequently, Congress should direct the appropriate agencies to phase out this highly misleading "impact" research.

Figure 64.3

Projections of IPCC Climate Models Compared with Observed Temperatures

SOURCE: Adapted from Intergovernmental Panel on Climate Change, Climate Change 2013: The Physical Science Basis. New York: Cambridge University Press, 2013.

NOTE: IPCC = Intergovernmental Panel on Climate Change; RCP = representative concentration pathway.

Ratify or Reject the Paris Agreement

Congress should determine that the Paris Agreement on climate change is a treaty subject to ratification by the Senate under Article 2 of the Constitution, and the Senate should request that the president submit it for consideration. On December 12, 2015, the Paris Agreement on climate change was introduced before a plenary session of the 21st Conference of the Parties to the United Nations' Framework Convention on Climate Change. It was to be presented for a voice vote for acceptance or rejection. In a very unusual action, U.S. Secretary of State John Kerry voiced an objection over a portion of Article 4.4. The language in question stated, "Developed country Parties shall continue taking the lead by undertaking economy-wide absolute emission reduction targets" [emphasis added]. He explained that this language changed the Agreement from an "executive agreement" into a treaty, which would require a two-thirds vote in the Senate for adoption. The office of the French presidency, which was in charge of the December meeting, eventually decided that this was a "typographical error."

However, the word "shall" appears in 142 other instances in the agreement, and some of these apply directly to developed countries such as the United States. For example, Article 9, paragraph 1 states, "Developed country Parties shall provide financial resources to assist developing country Parties with respect to both mitigation and adaptation in continuation of their existing obligations under the Convention." Clearly, that language directs countries to provide funding to developing nations. In the United States, that means spending taxpayer dollars, which can only be appropriated by Congress unless compelled under a treaty ratified by a two-thirds vote of the Senate — as laid out in Article 2 of the Constitution.

Article 7, section 13 of the agreement also commits the United States to financial support for the developing world: "Continuous and enhanced international support shall be provided to developing country Parties." Article 9, section 5 even refers to the payment of taxpayer dollars specifically: "Developed country Parties shall biennially communicate indicative quantitative and qualitative information related to paragraphs 1 and 3 of this Article, as applicable, including, as available, projected levels of public financial resources to be provided to developing country Parties" [emphasis added].

It is therefore incumbent upon Congress to emphatically state that the Paris Agreement is a treaty. The Senate should then request that the president forward the treaty for a ratification vote. And the Senate should then reject it.

Suggested Readings

Christy, John R. Testimony before the Committee on Science, Space, and Technology, U.S. House of Representatives, February 2, 2016.

Dayaratna, Kevin D., and David W. Kreutzer. "Loaded DICE: An EPA Model Not Ready for the Big Game." Heritage Foundation Backgrounder on Energy and Environment no. 2860, November 21, 2013.

---. "Unfounded FUND: Another EPA Model Not Ready for the Big Game." Heritage Foundation Backgrounder on Energy and Environment no. 2897, April 29, 2014.

Dayaratna, Kevin, Ross McKitrick, and David Kreutzer. "Empirically-Constrained Climate Sensitivity and the Social Cost of Carbon." Heritage Foundation and University of Guelph, April 5, 2016.

De Jong, Rogier, Sytze de Bruin, Allard de Wit, Michael E. Schaepman, and David L. Dent. "Analysis of Monotonic Greening and Browning Trends from Global NDVI Time Series." Remote Sensing of Environment 115, no. 2 (2011): 692-702.

Idso, Craig D. "The Positive Externalities of Carbon Dioxide: Estimating the Monetary Benefits of Rising Atmospheric CO2 Concentrations on Global Food Production." Center for the Study of Carbon Dioxide and Global Change, October 21, 2013.

Intergovernmental Panel on Climate Change. Climate Change 2013: The Physical Science Basis. New York: Cambridge University Press, 2013.

Kuhn, Thomas. 1962. The Structure of Scientific Revolutions. Chicago: Chicago University Press, 1962.

Lewis, Nicholas. "Implications of Lower Aerosol Forcing for Climate Sensitivity." Climate Etc. blog entry, March 19, 2015.

Lewis, Nicholas, and Judith A. Curry. "The Implications for Climate Sensitivity of AR5 Forcing and Heat Uptake Estimates." Climate Dynamics 45, no. 3 (August 2015): 1009-23. doi:10.1007/s00382-014-2342-y

Michaels, Patrick J., and Paul C. Knappenberger, 2016. Lukewarming: The New Climate Science That Changes Everything. Washington: Cato Institute, 2016.

Murphy, Robert P., Patrick J. Michaels, and Paul C. Knappenberger. "The Case against a U.S. Carbon Tax." Cato Institute Policy Analysis no. 801, October 17, 2016.

Office of Management and Budget. OMB Circular A-4, Regulatory Analysis. September 17, 2003.

Smaldino, Paul E., and Richard McElreath. "The Natural Selection of Bad Science." Royal Society Open Science 3 (2016).

Stevens, Björn. "Rethinking the Lower Bound on Aerosol Radiative Forcing." Journal of Climate 28 (2015): 4794-819.

Zhu, Z., et al. 2016. "Greening of the Earth and Its Drivers." Nature Climate Change 6 (2016): 791-95.