“Monetary policy operations” is one of the topics that capture the imagination of policymakers and academics only once in a blue moon. There is no doubt that those who manage central bank reserves play an important role in the way our modern financial system works. They attend to the financial plumbing that critically links the actions of a central bank to the financial system. They generally beaver away in relative obscurity as long as the financial system is working efficiently. However, just as with household plumbing, the financial plumbing gets our immediate and focused attention when it gets backed up.

It is not surprising then that issues of monetary policy operations have recently attracted renewed interest. In the past year, there have been several episodes—so far mainly temporary phenomena—of monetary markets “getting backed up.” Indeed, most market and official commentaries have largely concluded that the acute stress in money markets seen in mid-September 2019 and, for that matter, at the end of 2018, has one main source: the shrinking of the Fed’s balance sheet and the concomitant drain of liquidity in the form of reserves. Questions abound about whether these episodes are simply a series of one-off events or whether they are signs of a more fundamental corrosion of the financial pipes that could lead to more persistent and, possibly, larger failures in the future.

In this article, I will argue that recent money market stresses are, in many respects, symptoms of deeper pathologies. While it is true that these stresses have gone hand-in-hand with a smaller Fed balance sheet, the blame lies elsewhere. Namely, private-sector incentives to efficiently reallocate reserves in the financial system have weakened and, hence, undermined the soundness of money markets. At the same time, concerns are growing that the incentives to monitor the actions and motivations of money market participants have eroded. From this “incentives” perspective, many of the solutions generally being considered may be off the mark.

To sketch out the implication of this incentives perspective for reforms of the monetary policy operational framework, the paper is structured as follows. The next section offers evidence supporting the claim that the modestly shrinking Fed balance sheet is not the underlying cause of the money market stresses. I then address the question of why the floor system has not been working as advertised, emphasizing instead the deeper roots of the problem associated with the ways in which monetary policy operations have been adapted to the new financial regulatory environment. Finally, the article turns to some strategic and tactical options for reforming monetary policy operations that move in the direction of strengthening the efficiency of money markets while retaining the financial stability benefits of the new liquidity regulations.

Is the Shrinking Fed Balance Sheet to Blame?

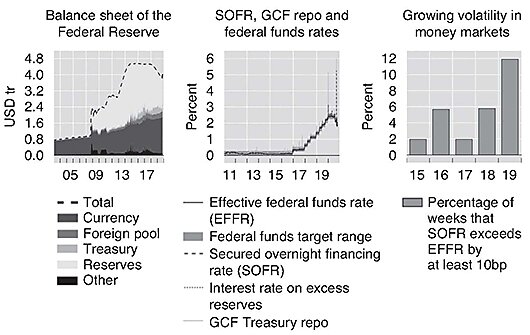

From 2017 to mid-2019, the Fed was in balance sheet normalization mode. Figure 1 (left-hand panel) highlights the inflection point in 2017 as the Fed started running off both Treasury securities and mortgage-backed securities (MBS). In July 2019, it announced an early end to the normalization process and in October decided to resume purchases, at least until the second quarter of 2020.

FIGURE 1: FEDERAL RESERVE’S BALANCE SHEET AND MONEY MARKETS

SOURCES: Federal Reserve Bank of St Louis (FRED); Bloomberg; author’s calculations.

Supporting Evidence

Over the same two-year period, money markets showed signs of greater volatility. Figure 1 (middle panel) presents several key money market rates: the effective federal funds rate along with the FOMC target rate-band, the general collateral financing (GCF) repo rate, and the secured overnight financing rate (SOFR). The GCF repo rate and SOFR are benchmark financing rates that reflect the price of overnight secured lending, usually involving Treasury securities and other high-quality liquid assets (HQLA). Three features in this graph stand out. First, the general rise in rates reflects the integrated nature of these secured finance money markets with the Fed’s policy rate. Second, in a somewhat anomalous fashion, secured financing rates can exceed the unsecured rate (i.e., the effective federal funds rate) and, indeed, have. This suggests money markets may not be fully efficient. Lastly, periodic spikes reflect ongoing vulnerabilities to acute liquidity stresses that the markets have not been able to diffuse before the spikes materialize, and the frequency of outsize moves in SOFR relative to the federal funds rate has increased over the past five years (Figure 1, right-hand panel).

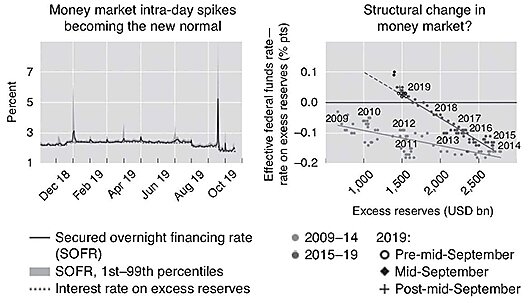

Of particular note, the level of stress in the secured funding markets registered a new extreme in 2019, as GCF repo rates and SOFR spiked (Figure 2, left-hand panel). The size of the spikes is notable.1 Given that the shadow of the crisis had largely faded, one would have expected to see more normal, not more volatile, conditions (Potter 2018). The timing was also unusual. It has been common to see rate spikes at the end of months, quarters, and years as financial institutions “tidy up” their balance sheets for regulatory and financial window dressing reasons. So the mid-September spike took on greater significance than its mere size. Understandably, the unusual behavior attracted considerable attention.

FIGURE 2: RECENT RATE SPIKES, RESERVES ADEQUACY, AND FINANCIAL PLUMBINGL What do recent rate spikes tell us about reserves adequacy and the financial plumbing?

SOURCES: Federal Reserve Bank of St Louis (FRED); author’s calculations.

Various hypotheses have been put forth to explain this behavior. A dominant theme in market commentaries is the shrinking Fed balance sheet. The argument is that a smaller Fed balance sheet squeezed available reserves and left market participants scrounging around for liquidity. The policy conclusion from this line of thinking is that an increase in the Fed’s balance sheet will help financial institutions sort out their financial needs, calm markets, and reduce the likelihood of overreactions in the future.

Contradictory Evidence from Money Markets

Is it obvious that the shrinking Fed balance sheet is to blame? Figure 2 (right-hand panel) presents striking visual evidence of a structural change in the relationship between money market rates and the size of the Fed’s balance sheet. Before the end of 2014, the light gray dots show a negative relationship between the secured money market rates relative to the floor rate of the Fed (i.e., the interest rate on excess reserves, IOER). As the Fed’s balance sheet grew (moving from left to right), competition led to a smaller gap between the secured money market rates and the IOER. That empirical relationship changed in the middle of the sample, as the earlier relationship represented by the light gray line twisted clockwise in the later period represented by the dark gray line. The newer relationship was still negative but much more steeply sloped.

Casting doubt on the shrinking Fed balance sheet hypothesis is the evidence on the timing of the structural break in the statistical relationship. It is clear that the structural break at the end of 2014 occurred several years before the Fed began implementing its normalization plan (i.e., the run-off of its Treasury and MBS assets starting in late 2017). The stability of the relationship since the break has been remarkable and covers both the balance sheet pause and the normalization.

The evidence of this relationship just before and after the September 2019 market turmoil casts further doubt. Figure 2 includes weekly balance sheet data around the time of the September rate spike. The circles ( ) represent data from early August to mid-September; the plus signs (+) represent data in the first half of October. Other than the two diamond shapes (♦) representing the third and fourth weeks of September, the statistical relationship appears unchanged since late 2014. The data for the second half of September look in retrospect like a few outliers in an otherwise stable structural relationship.

) represent data from early August to mid-September; the plus signs (+) represent data in the first half of October. Other than the two diamond shapes (♦) representing the third and fourth weeks of September, the statistical relationship appears unchanged since late 2014. The data for the second half of September look in retrospect like a few outliers in an otherwise stable structural relationship.

What happened during the period of these September 2019 outliers? The markets and the Fed were taken by surprise. Repo markets experienced extreme stress, as reflected in the rate spikes (one day hitting 10 percent!), which then kept markets on edge. It appears that the proximate cause of the higher volatility was the drying up of liquidity in the secured money markets. In response, the Fed reacted by supplying reserves in the market via open market operations. On the first day, the Fed faced some technical difficulties performing the reserves-supplying operations and only supplied about $53 billion out of the $75 billion in Treasuries and MBS securities. Significantly, this was the first time since the financial crisis that the Fed conducted major market interventions to calm stresses in money markets. The stresses finally subsided after a couple of weeks and multiple rounds of large Fed interventions.

So, what did we learn from this September episode of market turmoil? Clearly, the rate spikes were a visible sign that the U.S. financial plumbing had become clogged. The sharply wider gap between secured money market rates and the federal funds rate indicated that banks were unwilling or unable to recirculate reserves efficiently from those with excess reserves to those with need. It also showed that the Fed’s plumbers are good at clearing the clogs but can get caught off guard. And the Fed’s initial technical difficulties while ramping up its emergency actions raised questions about the ability to respond nimbly after sitting on the sidelines of these markets for such a long time.

This September 2019 episode also highlighted the fragile nature of money markets. They appear to have grown highly vulnerable to a virulent form of liquidity illusion: that is, liquidity buffers that appear ample when not needed but prove insufficient just when they are needed. Indeed, despite liquidity buffers appearing ample in 2019, the unwillingness of banks to release their liquidity buffers at the whiff of stress resulted in the outsized reaction in rates. This experience demonstrated that interconnected money markets subject to liquidity illusion risk can very quickly turn a minor liquidity squeeze into a clear and present danger.

All told, the facts presented in this section challenge the blame attributed to the shrinking Fed balance sheet. Instead, it is possible, if not probable, that other more structural factors were responsible for the more fragile liquidity environment and growing prominence of periodic rate spikes—namely, the regulatory environment and weaker incentives for financial institutions to reallocate excess reserves. To investigate the role of these factors, it is necessary to start by looking at the very foundations of the design and implementation of the floor system adopted by the Fed after the Great Financial Crisis.

Why Isn’t the Floor System Working as Advertised?

The Fed’s floor system, as opposed to the corridor system, is considered in many ways a relatively simple operating framework. A floor system does not require detailed monitoring of various hard-to-predict autonomous factors (e.g., Treasury balances, foreign investment pool, and so forth) that can adversely affect the ability of the central bank to hit its interest rate operating target.

Putative Benefits of an Abundant Floor System

The simplicity stems from its self-correcting design. The Fed oversupplies an abundance of reserves but allows banks to deposit any excess back at the central bank. These deposits are remunerated at the interest rate paid on excess reserves (IOER), set by the Board of Governors. This deposit facility creates an interest rate floor at which banks (and other financial institutions with direct access to the deposit facility) have no incentive to lend reserves at a lower rate. To see this, consider two cases in which a bank could find itself. In the case of an individual bank finding itself with too many reserves, it would just lend these reserves to other banks whenever the interbank rate exceeds the IOER or deposit them with the central bank at the IOER. In theory, as long as there are sufficient reserves in the system, competition would drive the (unsecured) overnight money market rate to the IOER. In the case of an individual bank finding itself short on reserves, it would seek to borrow reserves and pay the overnight money market rate. Theoretically, this would tie the federal funds rate to the IOER. With the unsecured funding rate at the IOER, secured funding rates would trade at a rate less than the IOER—at least in principle in an efficient market.2

The chief responsibility for the manager of Fed reserves in this system is to come up with an estimate of the demand for reserves and supply more than the estimate. Operationally, the reserves manager achieves this by undertaking open market operations (OMOs) to buy Treasuries. As demand trends upward over time, the Fed would have to occasionally bump up the level of reserves with additional rounds of OMOs.

One putative benefit of this system is that, with an excess supply of reserves, the financial system does not have to rely on the Fed manager to calibrate the “correct” liquidity injection each day. In a floor system, the hard-to-forecast idiosyncratic liquidity developments do not require daily rebalancing of reserves by the Fed. By contrast, in a corridor system, the manager needs to finely tune the amount of reserves injected in the system to ensure that there is not too little, not too much, but just the right amount. Achieving this Goldilocks outcome requires constant monitoring and scrutinizing of the precise liquidity needs of the market, day in and day out.

Likewise, in an ideal floor system, there is little need for private-sector money managers to worry about access to daily liquidity. As long as there are ample reserves in the financial system, the money markets should effortlessly reallocate the reserves from those with excess reserves to those who need them. In other words, a Fed manager of reserves and managers of private-sector liquidity do not have to be alert to the possibility of “air pockets” in liquidity that could incite financial market turbulence and interest rate volatility. Daily liquidity-shortage risks in money markets are minimal and the Fed manager need not be active in money markets on a daily basis. The opposite is true in a corridor system: the Fed manager and private-sector managers must be active in money markets. Indeed, each has a mutual interest in sharing private information about possible stresses to avoid being caught off guard.

Practical Challenges

Under such an ideal floor system, rate spikes of the type seen in September should not have materialized. Hence, the rate spikes and increase in money market volatility raise questions about the efficacy of the current floor system.

One possible explanation for the spikes is that the Fed and the markets seriously misjudged the level of reserves abundance. However, prior to the spikes, the Fed, academics, and senior financial officers all had estimated excess reserve thresholds to be hundreds of billion dollars below the level of reserves available in mid-September. The consensus was that there was an ample buffer.

Another possibility is that (autonomous) liquidity factors were exceptionally large and unexpected. It is true that September’s corporate tax payments and a big Treasury auction that contributed to a sharp rise in Treasury’s cash balance held at the Fed coincided with the spikes.3 But the levels of these factors remained within the recent historical range. As well, swings in the much-expanded foreign repo pool did not seem particularly volatile. It seems implausible that these developments alone were responsible for the mid-September surprise.

This leaves another possibility: structural flaws in the operational framework of the floor system. So, why might the floor system not work as advertised? In a floor system, it is assumed that reserves are passively passed on from banks with excess to those with need as soon as any rate wedge opens up between money market rates and the IOER. These banks always have an incentive to lend excess reserves as part of their liquidity management. In practice, however, each bank is much more opportunistic and faces a range of regulatory disincentives to arbitrage markets.

First, U.S. money markets are much more segmented than often assumed in theory. The fact that secured money market rates trade higher than unsecured rates is one sign. The IOER running higher than the effective federal funds rate is also a sign for most of the recent period. Part of this was due to the restricted access of key money market players to Fed facilities such as the IOER. Segmentation resulted in what is now called a “soggy” floor system of the Fed (see Bech and Klee 2011; Hamilton 2019).

Second, the segmentation has been exacerbated as liquidity management at financial institutions has become more conservative. In the wake of the Great Financial Crisis, regulators have naturally tightened up liquidity regulations and oversight. The regulations have altered various incentives to nudge financial institutions toward business models that reinforce financial stability (BIS 2019). As well, financial institutions have become much more alert to liquidity risks.

Third, enforcement norms also play a role as supervisors police the implementation of the new national regulatory rules (which, in many cases, go beyond the minimum standards laid out in Basel III). So far, supervisors have taken a conservative tone toward liquidity risks, which, in turn, has been influencing financial institutions’ decisions on the size of the liquidity buffers to hold in good times and in times of stress. This tone and uncertainty, which might be characterized as constructive ambiguity about how stringently the regulatory rules will be enforced, has also had implications for financial institutions’ decisions on the types of high-quality liquid assets to hold in order to satisfy rules on diversified funding sources. In this environment, financial institutions have exhibited considerable caution with respect to liquidity risks and buffers (Covas and Nelson 2019).

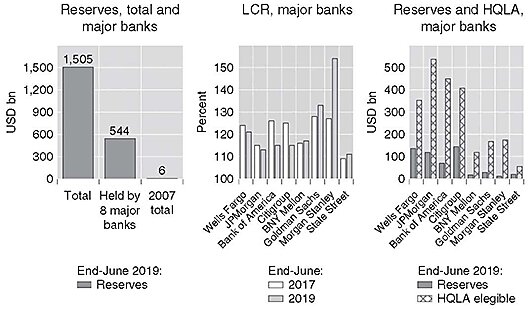

Fourth, several key postcrisis developments indicate that the underlying logic of the floor system appears to be at odds with reality. It is not surprising that financial market participants have shied away from “making” these markets in the new financial environment that appears to be characterized by ample reserves. Regulators have imposed a slew of postcrisis liquidity requirements, including the liquidity coverage ratio (LCR), the supplemental leverage ratio (SLR), the comprehensive liquidity assessment and review (CLAR), and especially the recovery and resolution regulations. These regulations have also tended to exacerbate money market segmentation and to erode the reallocative efficiency across the complex network of interconnected financial institutions (Duffie 2018). For the big banks that hold a disproportionate share of the reserves, the new regulatory environment has weakened incentives (that is, increased the balance sheet costs) to arbitrage the market for reserves. Figure 3 highlights that major banks, for example, had more HQLA than required by the regulations. Bank call report data show that eight major banks maintained large LCR buffers (Figure 3, left-hand panel), one-third of all reserves in the banking system (middle panel), and large stocks of HQLA (right-hand panel).4 In other words, these banks were sitting on a large cash cushion to cover unexpected cash outflows during periods of stress. The fact that they, and others, did not circulate them quickly as rates rose relative to the IOER provides a negative inference that these institutions were reluctant to lend out the excess reserves. Anecdotal evidence confirms this explanation.

FIGURE 3: RESERVE BALANCES HELD AT THE FEDERAL RESERVE: Why are there liquidity shortages with historically high reserve holdings across banks?

>NOTE: Reserves = reserves balances held at the Federal Reserve.

SOURCE: Call reports and LCR disclosures; author’s calculations.

Taken together, the unintended consequences of the new postcrisis regulations have been to tie up reserves, make it costly to arbitrage money markets (in terms of the leverage ratio), and incentivize the hoarding of reserves at the whiff of liquidity stress. Practically, this has slowed the process of reserves reallocation, which helps to explain the increased volatility across money markets seen in recent years and points to a growing likelihood of recurrent periods of acute money market stress. More worrisome, the condition of the financial plumbing could worsen further. Over time, this hysteresis could make it increasingly difficult and time consuming to repair the infrastructure of money markets.

In sum, the ideal floor system does not seem to be the best way to think about the reform challenges associated with redesigning a U.S. monetary policy operations framework. In part, we shouldn’t characterize the financial market as simply composed of passive institutions interested in efficiently reallocating reserves in a perfect financial system. Rather, segmented money markets comprise a diverse set of opportunistic participants in complex competitive organizations facing a range of regulatory and supervisory incentives for holding, and hoarding, reserves.5 And, with weaker incentives for both the Fed and the private sector to monitor developments—especially “air pockets”—in money markets, the risks of being caught off guard go up. Evidence over the past years suggests that these risks are materializing and may rise in the future.

The analysis in this section highlighted the challenges facing policymakers and raised the possibility that the Fed’s monetary policy operating framework may not be as efficient as it could be. Indeed, the Fed’s emergency actions in September 2019, to reflate its balance sheet in response to money market gyrations, indicates a need for change. Various options are on the table. The next section, based on an incentives perspective, argues that more market-based approaches may be more fruitful than some other approaches being discussed publicly.

Considerations for Reducing the Fed’s Operational Footprint: When Less Is More

This section discusses various options for reforming monetary policy operational frameworks. It first addresses strategic issues—that is, the appropriate roles for the Fed and private sector in promoting efficient money markets. It then turns to tactical issues focused on preventing recurrences of the acute stress witnessed over the past year. The discussion is not meant to be comprehensive but rather to highlight issues that may have been largely overlooked in the current debate.

Strategic Considerations

Options for addressing the existing inefficiencies in the money markets fall into two broad strategic categories: one that asks the Fed to shoulder more of the burden by increasing its footprint in money markets and another that looks instead to the private sector to take the lead.

The Fed-centric proposals have called for more quantitative easing and permanently increasing excess reserves. After mid-September, some suggested the Fed needs to recalibrate its target level for excess reserves, expanding them on the order of a few hundred billion dollars. New estimates range widely with some suggesting an increase of roughly a half-trillion dollars above the consensus estimates made earlier in the year. The underlying logic behind this view is that the floor system only works when reserves are sufficiently abundant. Evidence of spikes, the view goes, indicates that earlier estimates missed the mark.

Many drawbacks with the Fed-centric proposals are fairly well known. For instance, ensuring ample reserves holdings at each financial institution could transform the central bank into the liquidity provider of first resort rather than last resort. Such a role may be seen as going well beyond the existing mandate of the Fed. As well, there are concerns that the larger Fed footprint would contribute to the erosion of market incentives over time, thus requiring an even larger footprint, which erodes markets further, and so on. Atrophying of the financial market plumbing would worsen the incidence of acute liquidity stresses, which, in the limit, would make markets completely beholden to the Fed for liquidity.6 This slippery slope of financial and possibly fiscal dominance could have adverse consequences for monetary policy independence.7

From a reserves manager’s point of view, expanding the Fed’s footprint is both feasible and relatively easy to implement. But feasibility does not ensure desirability. Tough questions need to be asked. Is it desirable from a broad public policy perspective? Would such a new role represent a significant overburdening of the Fed when central banks in the postcrisis period arguably have been already overburdened? It seems clear that the choice of an expanded floor system is not without the possibility of serious side effects.

In contrast, market-centric proposals emphasize solutions that rely on boosting the incentives for financial institutions to efficiently allocate reserves in the money markets and to resist the temptation to hoard reserves. By incentivizing the private sector, the total level of reserves in the system could be much smaller as they would act as a stopgap buffer. As well, incentivizing the private sector to take the lead in reallocating reserves and the Fed to take the role of an agile follower could have dynamic benefits. A vibrant financial system is more likely to spur financial innovation in the financial plumbing and potentially build up more resilience to unexpected developments in the future. In the terminology of Taleb (2012), the market solutions offer the prospect for enhancing the “antifragile” nature of money markets and hence boost financial stability.

As for the downsides, the reserves manager would have to up his or her ability to monitor money markets, to detect emerging air pockets in the money markets, and to act nimbly to prevent financial turbulence from materializing. With financial globalization, these tasks may be more difficult than in the precrisis period. As well, the transition to a more market-based operating system may be challenging. Incentivizing markets to wean themselves off the helping hand of the Fed may prove difficult and time consuming after a decade of heavy Fed intervention in markets. Adjusting to the new regulatory environment may also require some experimentation. As a consequence, the transition period could prove quite bumpy. Such volatility could adversely affect the monetary transmission mechanism, complicate monetary policymaking, and ultimately undermine confidence in the Fed.

Tactical Considerations

Strategic considerations suggest two different tactical paths for the future. The more often discussed approach is permanently increasing the role of the Fed in liquidity provision. Namely, it would reverse the normalization of the Fed’s balance sheet and prepare for a secular abundance of excess reserves in the financial system. From a reserves manager’s point of view, the Fed would simply load up the balance sheet via periodic rounds of large-scale asset purchases and flood the money market with reserves. Some proponents of this view argue that this would tie down secured and unsecured money market rates to the policy rate and prevent future rate spikes.

Others suggest that even more needs to be done. One proposal receiving attention advocates that the Fed activate a new standing repo facility in order to cap periodic rate spikes in the secured money markets (Ihrig and Andolfatto 2019). Details about the standing facility (e.g., the size of the spread over the policy rate at which such a facility would be economically viable) are still up for debate. In a nutshell, a Fed standing facility would kick in automatically any time liquidity stresses push repo rates above a given threshold. For a low threshold, the facility would suppress money market volatility but disincentivize private-sector provision of liquidity insurance. A high threshold would allow more volatility but provide incentives for financial institutions to invest in a broad network of funding channels. Either way it would represent yet another expansion of the Fed’s footprint in money markets.8

Market-oriented options also deserve greater prominence in the debate. The advocacy for market-based solutions would start with an understanding that monetary policy operations are very amenable to responding to almost any regulatory changes in the financial system. It is well understood that a reserves manager has many degrees of freedom to hit the FOMC policy rate target. Indeed, the past 50 years have shown that despite all sorts of changes in the economy, in the financial system, and in regulations, managers have been able to adapt and hit the federal funds rate target specified by the FOMC. As well, if we were to look beyond the shores of the United States, the history of operational adaptability is truly impressive.

Therefore, it is important not to lose sight of the fact that what is tactically feasible is not always desirable. The reserves manager can achieve the policy rate mandate across a broad spectrum of circumstances—even if financial markets were to become quite distorted (Borio 2001). So, hitting the rate target, while essential, should not be perceived as being the yardstick for monetary policy operation framework success. It is in this context that we must be concerned about solutions that simplify the ability to hit the policy rate. It seems that the evaluation standard should be lexicographical—yes, a reserves manager should hit the policy rate objective but, having done so, should also aim to increase the efficiency and soundness of the financial plumbing.

Even though the new liquidity regulations are all meant to increase the resilience of the financial system and to avoid a crisis like the one we witnessed in the late 2000s, these regulations and internal liquidity risk management at financial institutions appear to have had unintended consequences for the efficiency of money markets.9 A key question is whether monetary policy operating framework reforms can retain the goals for financial stability while at the same time improve the operational efficiency of the money markets. This possibility depends crucially on the nature of the unintended consequences.

Unintended Regulatory Consequences and the Return to a Corridor-Type Operating Framework

A key unintended consequence arises from the regulatory treatment of reserves and Treasury securities. Treating these two types of assets as being largely substitutable, when satisfying the liquidity regulations and liquidity stress tests, means that the demand for reserves is hard to pin down. In recent years, there appears to be a significant incentive to stash one’s reserves away because of the lack of price volatility and the superior intra-day liquidity properties of reserves relative to Treasuries. Furthermore, market participants have interpreted utterances from the Federal Reserve as encouraging them to look kindly on using reserves to satisfy regulations.

However, the floor system tends to drive the return on reserves (at the IOER) and Treasury yields together, which distorts the intra-day market for liquidity. Intra-day, the moneyness quality of reserves is higher than that of Treasuries. So, when the returns on reserves and Treasury yields are equal, there is a strong incentive to rely heavily on reserves for banks’ systemic liquidity needs. Moreover, this systemic demand for liquidity goes hand-in-hand with a stronger incentive to hold on to reserves during transitory periods of money market stress. At those times when elevated stress puts a premium on moneyness, there is a tendency for liquidity demand to surge and supply available in the market to evaporate. In the limit, there may even be perverse incentives to hoard reserves.

The key for offsetting such market distortions is restoring a wedge between returns on Treasuries and reserves. In a floor system, this wedge is constrained to be small. But, a corridor system allows this wedge to grow because the market rate could stay well above the IOER in equilibrium. This gap would tend to rise when intra-day money market stress is high and fall when low. In this way, market forces would help to incentivize the efficient reallocation of reserves during normal times and in times of stress. As well, because of this palliative effect in expectation, the market for liquidity is likely to experience a lower frequency of acute stress.

Strengthening a Corridor-Type Framework with a Sequestered Reserves Rule (SRR)

The incentive effects of a corridor system could be further enhanced by having financial institutions preannounce the level of reserves that they will sequester to satisfy their regulatory and supervisory constraints. Under the SRR, regulators and supervisors would regularly negotiate with financial institutions the appropriate preannounced level of reserves necessary to satisfy liquidity regulations. Being focused purely on financial stability goals, the negotiations would emphasize safety, the avoidance of reserves hoarding, and the use of reserves as part of a well-diversified basket of HQLA. The negotiations would also aim to clarify the intent of the supervisors and encourage a better mutual understanding of what is expected.

In principle, the regulatory and supervisory demand for reserves could be preannounced in as little as a few days. The Fed’s reserves manager would then flexibly accommodate such systemic liquidity variation without adversely affecting daily liquidity developments or price discovery in money markets arising from payment flows.10 Effectively, the SRR would prevent the decisions about reserves that are held for regulatory reasons from influencing the efficiency of the unsecured and secured markets.

The sequestered reserves rule offers several money market benefits. First, the SRR would reduce adverse spillovers from the new liquidity regulatory regime on daily money market activity. The SRR would reduce short-term volatility in this use of reserves for regulatory reasons (Ihrig et al. 2019). Second, the SRR would reinforce the effectiveness of systemic liquidity regulations for financial stability reasons. Counterparty liquidity risks would fall and as a result help to restore money market dynamism.

An added SRR benefit is the salutary effect on repo markets during periods of stressed liquidity conditions. By preannouncing the level of sequestered reserves for regulatory purposes, any unexpected increase in HQLA demand due to transitory stresses would boost demand for nonreserves HQLA. This demand would have to be satisfied with an array of eligible HQLA, such as Treasury securities. Instead of giving incentives to dump Treasuries (and other nonreserves HQLA) and hoard reserves at the whiff of liquidity stress, the SRR would boost demand for Treasury securities and hence help calm repo markets during stress events. The result would be repo markets that are more antifragile as they bolster the ability of money markets to efficiently settle payments and deliver securities (or transfer collateral) across a wider range of financial environments.11 Also, banks would be more willing to reallocate time-critical reserves in both unsecured and secured money markets and reduce the likelihood of rate spikes more so than in a corridor-type framework without SRR.12

Nontrivial Byproduct of an SRR Corridor Framework: Reinvigorating Money Market Surveillance

One last, but surely not least, benefit of a corridor-type system with the SRR enhancement is the increased incentive to monitor money markets and ensure that the Fed and market participants are not caught off guard. In contrast to a floor framework, a reserves manager must devote considerable bandwidth to monitoring daily and intra-day liquidity conditions in money markets. The normal operation of the corridor system requires a deft understanding of the complexities of money market plumbing. This understanding benefits from daily market operations. By conducting daily operations, market participants build up reliable networks that foster an environment of good information flows among the market participants and between them and the Fed. When it comes to information acquisition in this market, it takes two to tango. It works best if everyone is on their toes. In this respect, a corridor-type system provides a win-win set of incentives for information sharing.

As well, such a system promotes accountability. The ability to prevent spikes in this system would serve as useful feedback that the Fed’s surveillance efforts are effective. In the floor system, it is more likely that the Fed and the private sector will be taken by surprise as they take their collective eyes “off the ball” and hence “drop the ball” from time to time. If this analysis is correct, under a floor system, there will be more periods of market strains morphing into stress and more Fed challenges when trying to calm markets nimbly and effectively.

Conclusion

The 2019 money market rate spikes reinvigorated the debate about monetary policy operational framework reform. There appears to be a growing consensus that doubling down on the postcrisis floor approach with a bloated central bank balance sheet is the way to go. This article questions that view and suggests that other options be considered.

If the mid-September rate spikes were warning signs of increased money market segmentation and weakened incentives to arbitrage money markets, the floor approach might not be the best way forward. True, the Fed’s September 2019 response with open market operations and a promise to increase its balance sheet stabilized the money markets. But this stability may prove to be only fleeting. Increasing the Fed’s money market footprint could, in the end, further weaken market incentives to reallocate excess liquid funds and hence make markets progressively more fragile, not more antifragile. More efforts to measure and monitor the degree of antifragility are urgently needed.

If this diagnosis is correct, market-based reforms may prove to be a more effective approach. Such reforms would need to aim to strengthen incentives for market participants to arbitrage markets and efficiently reallocate liquid funds from those with excess to those with payment needs. This vision of monetary policy operational framework reforms is not some elaborate pipe dream. In many respects the modest two-pronged approach described in this article is based on returning to the tried-and-true framework of the precrisis period. By reinstating a precrisis corridor-type system, the Fed would operate with a much-reduced balance sheet and be actively engaged in money markets each and every day.

Such a system naturally restores differential pricing for reserves versus Treasuries, bolsters incentives for intra-day arbitraging of money markets, and disincentivizes reserves hoarding. As well, the associated smaller central bank balance sheet would yield additional benefits. It would return the Fed to the role of marginal liquidity provider in money markets, which goes hand-in-hand with stronger incentives for both the Fed and market participants to monitor money market “air pockets.” Having the Fed and market participants “lean in” actively day-in and day-out would improve information acquisition and sharing of real-time liquidity conditions. This would reduce the likelihood that the Fed and markets will be caught off guard.

This article argues that a novel sequestered reserves rule would significantly enhance the benefits of a return to a precrisis corridor-type system. It calls for financial institutions to precommit to a given level of sequestered reserves solely to address regulatory rules. The main thrust of the SRR is to help prevent adverse spillovers from the regulatory environment onto money market efficiency. Operationally, the appropriate size of the liquidity buffer would involve discussions between supervisors and financial institutions, based in part on the regulatory principle that HQLA should be ample and well-diversified with respect to their structure, tenor, and currency. Such a precommitment would make the demand for reserves more predictable and hence reduce the incidence and severity of intra-day reserves hoarding. During periods of liquidity strains, this proposal would have an added repo market benefit. Repo market antifragility would strengthen because, as liquidity risk rises, financial institutions would have regulatory and business reasons for building up their holdings of nonreserves HQLA, which would tend to moderate repo rate volatility. Finally, given the universe of available HQLA, all the benefits could be achieved without compromising the main thrust of new liquidity regulations and their enforcement for financial stability reasons. Indeed, a more efficient money market less prone to acute stress would contribute to the attainment of the goals of the new liquidity regulations for strengthening financial stability.

Overall, the modest two-pronged market-based approach outlined in this paper has the potential to boost dynamism in money markets—making them more antifragile. And it would serve as a good starting point for a broader discussion of additional reforms that might be necessary. It should be recognized, however, that repairing money markets may take some time given the past decade of overreliance on the Federal Reserve. Ideally, after an initial implementation stage, money market stakeholders would reassess the liquidity environment and consider whether additional reforms were needed. Only time will tell whether this modest two-pronged approach is enough to reduce the Fed’s footprint in money markets, while at the same time boosting money market efficiency and financial stability.13

References

Baughman, G., and Carrapella, F. (2019) “Federal Funds Rate Control with Voluntary Reserve Targets.” FEDS Notes (August 26).

Bech, M., and Klee, E. (2011) “The Mechanics of a Graceful Exit: Interest on Reserves and Segmentation in the Federal Funds Market.” Journal of Monetary Economics 58 (5): 415–31.

Bindseil, U. (2016) “Evaluating Monetary Policy Operational Frameworks.” Paper presented at the 2016 Economic Policy Symposium at Jackson Hole, Wyoming (August 31).

Borio, C. (2001) “A Hundred Ways to Skin a Cat: Comparing Monetary Policy Operating Procedures in the United States, Japan and the Euro Area.” BIS Papers 9. Available at www.bis.org/publ/bppdf/bispap09.htm.

BIS (2019) “Large Balance Sheets and Market Functioning.” Markets Committee Papers 11 (October). Available at www.bis.org/publ/mktc11.htm.

Cochrane, J. (2019) “Operating Procedures.” The Grumpy Economist (March 29).

Covas, F., and Nelson, W. (2019) “Bank Regulations and Turmoil in Repo Markets.” BPI Note (September 26). Available at https://bpi.com/wp-content/uploads/2019/10/Bank-Regulations-and-Turmoil-in-Repo-Markets.pdf.

Duffie, D. (2018) “Post-Crisis Bank Regulations and Financial Market Liquidity.” Baffi Lecture (March 31).

Hamilton, J. (2019) “Perspectives on U.S. Monetary Policy Tools and Instruments.” Paper presented at Strategies for Monetary Policy: A Policy Conference. Hoover Institution, Stanford University (May).

Ihrig, J., and Andolfatto, D. (2019) “Why the Fed Should Create a Standing Repo Facility.” On the Economy Blog (March 6).

Ihrig, J.; Kim, E.; Kumbhat, A.; Vojtech, C.; and Weinbach, G. (2019) “How Have Banks Been Managing the Composition of High-Quality Liquid Assets.” Federal Reserve Bank of St. Louis Review 10 (3): 177–201.

Kahn, G. (2010) “Monetary Policy under a Corridor Operating Framework.” Federal Reserve Bank of Kansas City Quarterly Review (4th quarter): 5–34.

Martin, A.; McAndrews, J.; Palida, A.; and Skeie, D. (2019) “Federal Reserve Tools for Managing Rates and Reserves.” Federal Reserve Bank of New York Staff Reports No. 642 (April).

Martin, A.; McAndrews, J.; and Skeie, D. (2016) “Bank Lending in Times of Large Reserves.” International Journal of Central Banking 12 (4): 193–222.

Monnet, C., and Vari, M. (2019) “Liquidity Rations as Monetary Policy Tools: Some Historical Lessons for Macroprudential Policy.” IMF Working Paper No. 19/176 (August).

Plosser, C. (2018) “The Risks of a Fed Balance Sheet Unconstrained by Monetary Policy.” In M. Bordo, J. Cochrane, and A. Seru (eds.), The Structural Foundations of Monetary Policy, 1–16. Stanford, Calif.: Hoover Institution Press.

Potter, S. (2018) “U.S. Monetary Policy Normalization Is Proceeding Smoothly.” Remarks at the China Finance 40 Forum—Euro 50 Group—CIGI Roundtable, Bank of France, Paris (October 26).

Selgin, G. (2018) Floored: How a Misguided Fed Experiment Deepened and Prolonged the Great Recession. Washington: Cato Institute.

___________ (2019) “The Fed’s New Operating Framework: How We Got Here and Why We Shouldn’t Stay.” Cato Journal 39 (2): 317–26.

Singh, M. (2017) “Collateral Reuse and Balance Sheet Space.” IMF Working Paper No. 17/113 (May).

Taleb, N. N. (2012) Antifragile: Things That Gain from Disorder. New York: Random House.

Williamson, S. (2019) “Interest on Reserves, Interbank Lending, and Monetary Policy.” Journal of Monetary Economics 101: 14–30.

About the Author

Andrew Filardo is a Visiting Fellow at the Hoover Institution at Stanford University. He is on a sabbatical from the Bank for International Settlements. The views expressed in this article are solely those of the author and do not necessarily reflect those at the Bank for International Settlements or the Hoover Institution. He thanks John Cochrane, Darrell Duffie, Kelly Eckhold, Neil Esho, Bill Nelson, Pierre Siklos, Manmohan Singh, and Miklos Vari for sharing their valuable insights and comments. He also thanks Alan Villegas for excellent research support and the International Monetary Fund for hosting him during the first year of his two-year sabbatical when this article was substantially written.

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.