New leadership is coming to the congressional tax-writing committees. Ron Wyden will be taking the helm of Senate Finance and Paul Ryan will be likely taking the helm of Ways and Means. This is good news, as both gentlemen are serious legislators and very interested in major tax reform.

One thing they should tackle is the personal income tax, which is a complex and high-rate mess. It should be restructured into a simple flat tax.

However, the most urgent needed reform is to slash the corporate income tax rate. Policymakers should put aside changes to deductions, credits, and loopholes for now. Those tax base issues are a diversion and policy quagmire, as the R&D credit illustrates. It is far more important to just cut the statutory corporate rate, which would automatically reduce the effects of tax-base distortions and make it politically easier to reform the tax base later on.

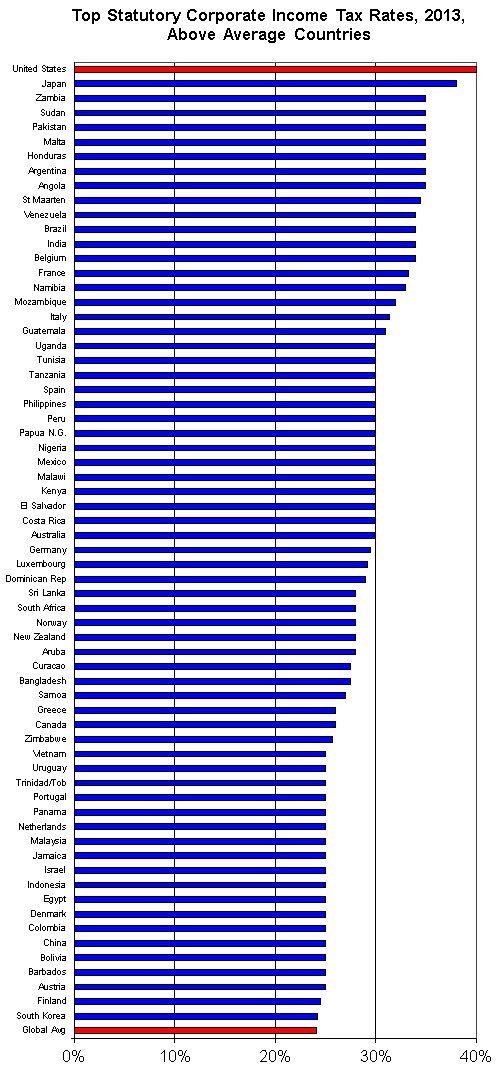

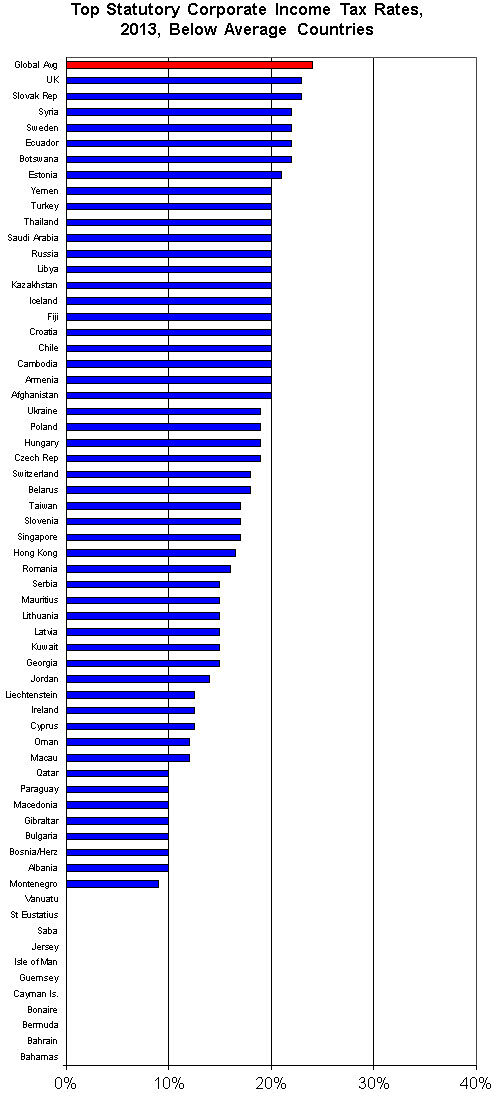

Our current high-rate policy is harming the U.S. economy, reducing job growth, and stifling wages—for no good reason. Abolition is a good long-term goal for corporate income tax reform, but we can start with at least chopping our federal-state rate of 40 percent down to the global average of 24 percent.

The charts show KPMG data for top statutory corporate income tax rates in 2013. KPMG shows UAE with the highest rate in the world at 55 percent. However, that rate just applies to foreign banks and foreign oil companies. So I don’t show UAE since the reported rate is not the general corporate rate.

That leaves the United States with the highest general corporate tax rate in the world, and that makes no sense in today’s competitive global economy.